October 3, 2016

The HTML file below deals with the perception of trading decisions within the context of building a long-term stock portfolio. It is the continuation of a series of articles dealing with the underlying math behind a stock trading strategy.

Instead of looking for a trading strategy that tries to shift its portfolio weighs from period to period as in a Markowitz or Sharpe rebalancing scenario, the search is for long-term repeatable procedures that can affect a portfolio's payoff matrix over its entire multi-period multi-asset trading interval. The main interest is not in a trade here and there but in the possible thousands and thousands of trades over a portfolio's lifespan. All are influenced by the trading functions put on the table.

The HTML file below highlights the output of a trading strategy and what should be done to improve upon it. It can be resumed in two charts:

#1 Average Win Distribution

(click to enlarge)

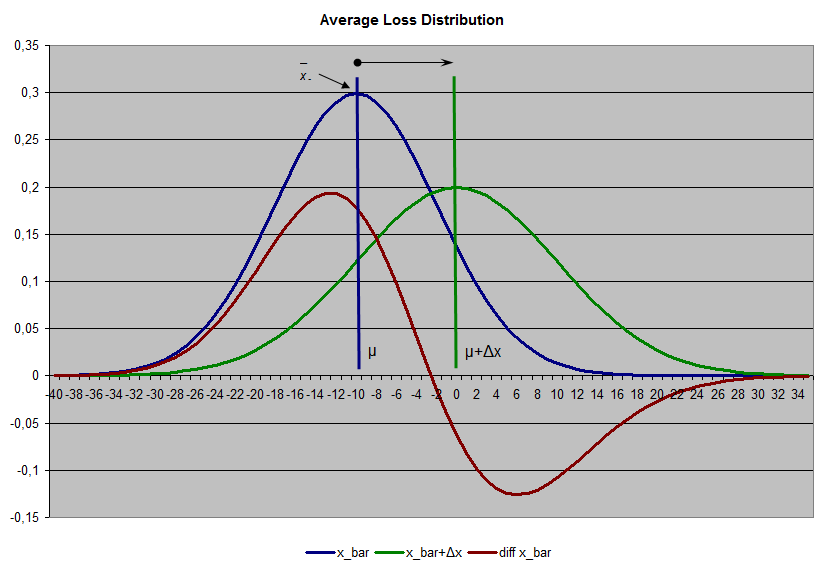

#2 Average Loss Distribution

(click to enlarge)

A trading strategy should have for objective to shift to the right the average profit per trade. Doing so will improve overall performance.

These articles are a lot more for my benefit than anything else. They serve as preparation for my game plan to gain a better understanding of what I need to do. I don't want to just convert some of my existing trading strategies from one language to another. I want to do more and produce better overall programs and trading strategies. To go beyond what I have done before. Hope it can help others design their own better strategies based on these observations.

This document is being offered in HTML due to the many formulas.

HTML file: Stock Trading Decisions

________

Related articles part of this series, as they were written:

The Payoff Matrix

The Game Inside

Strategy Design Defects

Strategy Enhancers

To give you an idea of what is coming, see also the series:

A Simple Stock Trading Strategy: Part I, Part II, and Part III.

Created... October 3, 2016, © Guy R. Fleury. All rights reserved.