Fleury's OPPW TQQQ Strategy: A CASINO GAMING EQUATION

February, 5, 2026

We rarely find an explicit equation to explain the inner workings of a stock trading strategy. A short-term trading strategy with many trades and a long-term horizon may be too complex to reduce to an equation, as it may yield only an outcome, not what goes on behind the scenes. We can always analyze that outcome or provide generalized future value estimates, but rarely will we know why or how we got those results.

My new article is about the inner workings of my version of the OPPW TQQQ trading strategy. It is also a continuation of Dealing with Randomness.

I explore the mathematical similarities between my OPPW equation and a casino-like roulette wheel. I show that, with an added "feature", both the OPPW game and roulette can use the same equation to analyze past outcomes and make projections of future results. It all stands on an equal sign, which is a brutal an unforegiving statement to make.

Fleury's OPPW TQQQ Strategy: DEALING WITH RANDOMNESS

Jan. 19, 2026

In trading stocks, no one can deny how easy the thing is, however you do it. You buy some shares for whatever reason, hold them or resell them, hopefully, at a profit. You can get richer or poorer doing this. The silly thing is that the game's long-term outcome is a choice you make.

No one can force you to trade short-term or invest for the long term. You are always responsible for any trade you do. You, or your trading software acting as your proxy, is in charge. In the end, no matter how you did it, even if you delegated the task, it will always come back to you, who technically allows the trades either by a surrogate or by letting a software program do it. All opened and closed trades will go into or out of your trading account.

My Fleury's OPPW TQQQ Strategy: NEWBORN ACCOUNTS

Dec. 18, 2024

Since 2014, I've written many articles suggesting parents start a stock investment portfolio for their children from birth. The reason is simple: by the time they reach 20, they will already have 20 years of compounding on their side. Adding an annual contribution to the fund would further increase the outcome.

It could give these children the starting capital they need for the next 20+ years following their 18th birthday.

Furthermore, it could serve as a starting point for building their own investment, retirement, and legacy fund. They would have 47 years of compounding before they retire.

My OPPW TQQQ Trading Strategy: ADDING LEVERAGE?

Dec. 15, 2025

We have a special investment program in my Fleury's OPPW TQQQ trading strategy. It has a simple objective: to win the long game. It is not a wish or some hype, but the outcome of how the strategy is structured.

Its trading rules take advantage of the randomness in TQQQ's wider price gyrations. The main reason for these spectacular long-term returns lies in the strategy's trading procedures and its ability to claw back, at will, any of its bets.

It's the only game in town where you can take back your bet, or most of it, after it was made, and for whatever reason you might have. This ability gives you a tremendous advantage in a quasi-randomly evolving price series having a long-term bias to the upside.

In ADDING LEVERAGE? I will explore some possible uses of my trading strategy to help you build your retirement and legacy fund of significance.

My OPPW TQQQ Trading Strategy: IT'S YOUR FINANCIAL FUTURE

Dec. 4, 2025

My previous article, YOUR MULTI-MILLION DOLLAR QUEST, showed some of the strategy's potential and ended with a call to further improve it. Places where the program could be improved were also provided.

Using my strategy's portfolio equation, I made projections and estimates for the next 20 years, providing a starting point for further research and enhancements that would lead to even higher performance. Here is a chart from my November 24, 2025, article cited above.

My OPPW TQQQ Trading Strategy: YOUR MULTI-MILLION DOLLAR QUEST

Nov. 24, 2025

You want to build a substantial retirement fund of at least $10 million within 20 years. You want the money for the financial freedom it can give you.

It's simple: you want it all.

The problem is that no one wants to give you that $10 million. Therefore, how about doing it yourself?

If you could raise $100,000 through creative financing, would you undertake this 20-year journey even if it had ups and downs of unknown magnitude? The task, at first glance, seems insurmountable. Not enough money, not enough time, not high enough expected returns.

My OPPW TQQQ Trading Strategy: A GAME TO WIN, AND... IT'S ON YOU

Nov. 5, 2025

Whatever stock trading strategy you intend to use, you will be facing the right edge of any of those stock charts every single day. It is not a choice. It is the future. For most stocks, that future is often unpredictable. You need a long-term view of your stock portfolio since it can also serve as your retirement fund and be the foundation of your financial freedom.

The objective is to demonstrate the benefits my One Percent Per Week (OPPW) trading strategy could bring you and help you reach your retirement goals trading the 3x-leveraged TQQQ ETF.

Your investment strategy will not be played in the past (through simulations, backtests, or financial hypotheses). What will matter is tomorrow and thereafter, it is where you need to win. Not that you hope to win or want to win — everybody wants that — but that you have to win.

My One Percent Per Week TQQQ Trading Strategy: MAKING IT YOURS

Oct. 14, 2025

In my Sept. 2025 article, A WINNING EXAMPLE, my OPPW TQQQ ETF trading strategy was shown to have a long-term vision on a "game" you can play and win. In its simulation, the game made a bet every week over the past 15.5 years, achieving a better than 60% CAGR using simple trading procedures.

Anyone with $100k could execute it from anywhere using their cellphone in less than 5 minutes per week, if they wanted to. The free trading script could do it in seconds.

The strategy yielded high long-term returns, significantly outperforming expected market averages. This strategy is not hype. Be skeptical and critical; verify everything yourself. Once you verify that everything holds up, you will determine whether to accept those results. Nonetheless, that is not the most critical point. What is: will you apply it or not in the years to come?

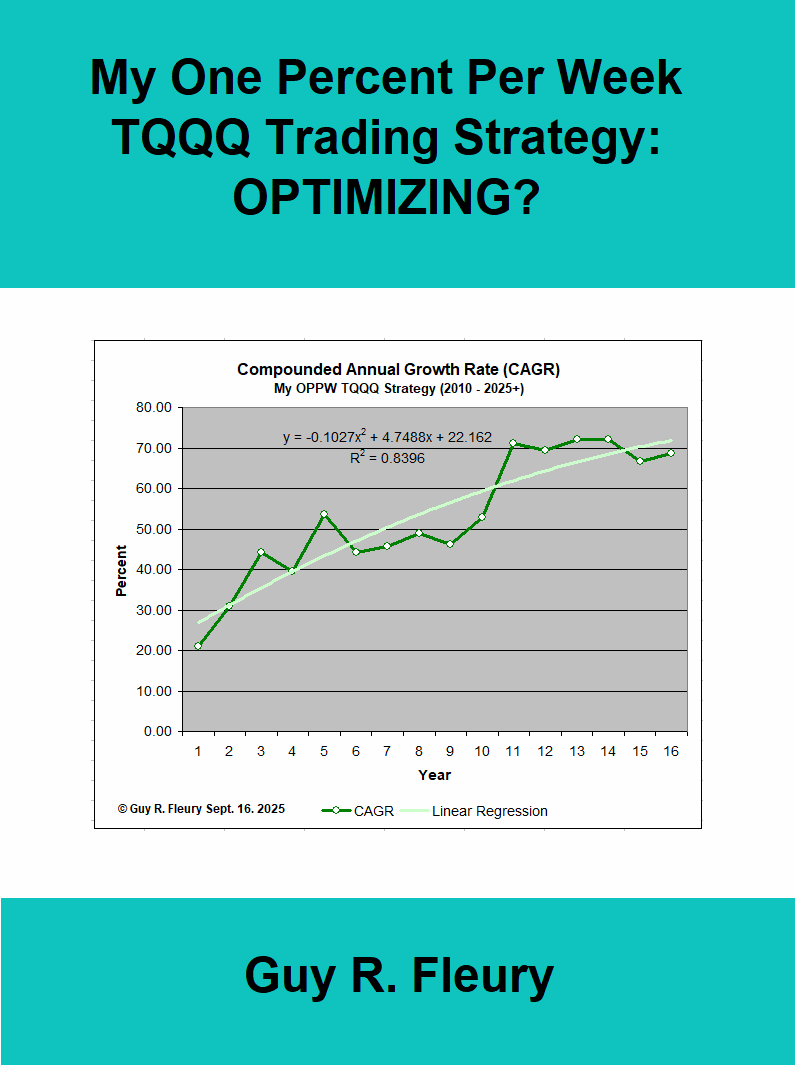

My One Percent Per Week TQQQ Trading Strategy: OPTIMIZING?

Sept. 29, 2025

The primary objective of my new paper is to demonstrate how you can utilize this singular trading strategy to build a substantial retirement fund over the next 15 to 20 years.

My One Percent Per Week TQQQ Trading Strategy: A WINNING EXAMPLE

Sept. 4, 2025

In this new article, A WINNING EXAMPLE, I highlight how one person improved my OPPW TQQQ trading strategy, simply by changing its trading rules.

I showcase how Carlos Azuero Rodriguez improved his version of the strategy to increase overall performance.

My last article, A WINNER'S GAME, emphasized that the trading strategy had more to offer by adding the proposed improvements. In my recent paper, THE ANTICIPATED FUTURE, I showed that the impact would be even more dramatic in the long term, for instance, over the trading interval between years 15 and 20.

My One Percent Per Week TQQQ Trading Strategy: A WINNER'S GAME

Aug. 28, 2025

In A WINNER'S GAME, I will outline the steps I can take to improve the outcome of my version of the OPPW TQQQ trading strategy, which, in turn, should enhance the strategy's performance.

My recent paper, THE ANTICIPATED FUTURE, emphasized that the strategy would have more to give after the proposed improvements. The impact would be even more dramatic over the trading interval between years 15 and 20. My version of the strategy, as demonstrated in its simulated results, achieved an impressive 57.39% CAGR over the last 15.5 years of trading. TQQQ started trading in February 2010.

My One Percent Per Week TQQQ Trading Strategy: THE ANTICIPATED FUTURE

Aug. 12, 2025

My new free paper treats the OPPW TQQQ trading strategy as if in a gambling scenario with odds in your favor, making you win the game over the long term.

The One Percent Per Week TQQQ Trading Strategy: KA-CHING, KA-CHING

July 28, 2025

My version of the One Percent Per Week TQQQ trading is unusual. With its simple weekly trading rules, it has maintained a portfolio average growth rate of 56% compounded annually over the last 15+ years. It had a 1% average profit per trade, which is remarkable. These numbers may seem hyperbolic, but you can verify them yourself. You can find a copy of the WL8 program in my free book, Gain Your Financial Freedom.

In my last article, AMPLIFYING YOUR STAKE, I demonstrated the impact of decisions you could apply before running my version of the One Percent Per Week program to improve its outcome. Even before making program changes, its 15+ year simulation exceeded, by a considerable margin, what you could have achieved using traditional portfolio management methods or index funds.

The One Percent Per Week TQQQ Trading Strategy: AMPLIFYING YOUR STAKE

July 14, 2025

This article will look at the initial conditions applied in my version of the One Percent Per Week (OPPW) trading strategy, which could enhance the total outcome. If we can increase the result of the strategy by amplifying some of its properties, shouldn't we at least be aware of those measures before engaging in this long-term venture?

We need to put these winning conditions in place before we start. Otherwise, by the end of the investment period, it will be too late and of no consequence. It is not after that we will be able to do something; there is no redo button in live trading, as the past is just history.

The One Percent Per Week TQQQ Trading Strategy: WANTING MORE

July 2, 2025

With some 30 articles on the One Percent Per Week (OPPW) TQQQ trading strategy, with several walk-forwards and out-of-sample simulations, with numerous descriptions of its inner workings, it is now time to enhance this trading strategy and increase its future potential.

I see my OPPW trading strategy within anyone's reach, provided they have the determination, perseverance, and means to execute it. This is a tool that can help you achieve your investment or retirement goals of becoming financially independent and more.

My objective, in wanting more, is to add new features without compromising the trading philosophy or intrinsic benefits of the strategy. I will strive to enhance overall performance without overfitting or remodeling past anomalies or infrequent price patterns. Additionally, I want to prioritize the type of modifications that will yield the most results and focus on those first.

The One Percent Per Week TQQQ Trading Strategy: A WALK-FORWARD

June 12, 2025

I first published the results of my version of the One Percent Per Week (OPPW) trading strategy in early May 2024. We can compare how the strategy has performed to date, showing its performance over the past year. It is the same process as a walk-forward, where you let your program run as if trading live on data it has never seen before.

My program makes one trade every week with no consideration of market conditions whatsoever.

Since last year, the strategy has added 57 new trades and had a 56.5% compounded annual growth rate (CAGR). We can consider those 57 weeks as a walk-forward period, as the program remained unchanged and was unaware of its future outcomes.

The One Percent Per Week TQQQ Trading Strategy: FINANCING THE OPPW

June 5, 2025

This article's primary purpose is to provide ideas on how to finance my version of the One Percent Per Week TQQQ trading strategy. If you already have enough money to start it going, congratulations, and forge ahead. For those who lack sufficient capital or are seeking more, the following should give you some ideas to consider to get the most from this outstanding trading strategy.

My version of the OPPW strategy can generate an average long-term return of about 1% per week, as demonstrated in my previous articles.

The OPPW strategy aims for an average compounded return of more than 60% per year. The latest 15-year simulation achieved a 56% compound annual growth rate (CAGR), which is very commendable. Very few strategies reach those levels over the long term. Yet, anyone could achieve such performance levels simply by using the OPPW strategy.

The One Percent Per Week TQQQ Trading Strategy: THE GAME YOU WILL WIN

May 22, 2025

This article wants to continue building on The One Percent Per Week trading strategy, and this time, emphasizing its gaming features, statistics, and probabilities. The objective will be to provide a better understanding of its structural gaming edge within the game. I will demonstrate the long-term survivability of its designed edge.

It will be similar to considering the rules a casino might apply in its games. They predetermine a statistical edge to their advantage, making any game they offer to the public long-term money machines. They know the long-term percentage contribution for each game feature they will implement.

The One Percent Per Week TQQQ Trading Strategy: THE EXPECTED UNEXPECTED

May 6, 2025

In this article, I will look for inconsistencies in my published version of the TQQQ trading strategy's application. It will be a relevant and simple description of what is there, leading to what may be an unexpected conclusion.

Over the past few articles, I performed tens of thousands of 15-year simulations on The One Percent Per Week (OPPW) strategy using TQQQ's WL8 simulation metrics. For starters, no one would think of continuously putting all their trading account into a single stock, but here, I am proposing just that and using a single 3x-leveraged ETF.

It can make quite a difference to one's outlook. As we know, TQQQ tracks the QQQ ETF and wants to generate 3x QQQ's daily return. It also means more volatility, larger drawdowns, and uncertainty, but a higher long-term expected return. See the TQQQ website page for its compounded return. The average rate of return for TQQQ since February 2010 has been over 40% compounded.

The One Percent Per Week TQQQ Trading Strategy: MAKING IMPROVEMENTS II

April 24, 2025

This article aims to improve the trading program in places I know will have a long-term positive impact, as described extensively in my recent articles. These added or modified trading procedures will seek no objective other than higher profits.

A persistent question is whether the program modifications will be profitable over the long haul.

As said in my previous article, The One Percent Per Week TQQQ Trading Strategy: MAKING IMPROVEMENTS, on trading strategy improvements, I cannot predict the price move for next week. However, over the long term, we can all see that the market trend, on average, has been on the upside for decades. Therefore, we can make averages of the average trading behavior of our procedures and evaluate their impact on our strategies' outcomes.

We might not know the outcome of a coming short-term trade, as if its result were subject to an unknown and biased coin flip. But we still know, on average, that our trading strategy does so and so.

A trading strategy's past behavior already tells us something that might be more valuable than we think.

The One Percent Per Week TQQQ Trading Strategy: MAKING IMPROVEMENTS

April 7, 2025

In this article, my interest will be in finding ways to improve the overall long-term performance of this outstanding trading strategy.

I cannot predict the price move for next week. However, over a long trading interval, I can make averages of what I consider as the average behavior for the trades taken and determine if those averages can persist. It will make a difference in how we view our long-term goals.

We might not know the outcome of a coming short-term trade, as if its result were subject to a coin flip. But we still know that, on average, our trading strategy does so and so. Its past behavior is already telling us something that might be more valuable than we think.

Link to complete article: MAKING IMPROVEMENTS

The One Percent Per Week TQQQ Trading Strategy: MY EQUATION

March 26, 2025

In The One Percent Per Week TQQQ Trading Strategy: MY EQUATION, I explore its use and describe the inner workings of the One Percent Per Week (OPPW) strategy trading the TQQQ ETF, elaborating on its properties and potential forecasting abilities.

ONE PERCENT PER WEEK STRATEGY: SOME TRADING HABITS

March 3, 2025

In the One Percent Per Week Strategy: Some Trading Habits, I will entertain the notion of what this particular trading strategy is telling us based on its trading history and how, in the future, it will behave similarly.

With this information and the strategy's demonstrated trading habits, we can make reasonable approximations on its future long-term outcome.

Even if the strategy has to handle the market's vagueries and randomness face-on, it will nonetheless manage to extract profits from its trading environment.

ONE PERCENT PER WEEK STRATEGY: TRADE DISTRIBUTION

February 18, 2025

In the One Percent Per Week Strategy: Trade Distribution, the proposition is to use the TQQQ trading strategy and make trades lasting at most 5 trading days. Due to this time limitation, we will have to deal with the market's randomness face-on.

The trading rules applied are not carved out of fundamental or technical analysis. The strategy is solely based on gaming circumstances and stopping times. It gets in a trade at the open every Monday simply because it is Monday. A trade is taken not because of price or some indicator. It is like flipping a coin every Monday and betting head every time.

We have 15 years of price data on the 3x-leveraged TQQQ ETF based on the QQQ ETF. TQQQ attempts to respond to QQQ's every move and will try to replicate 3 times QQQ's daily return. TQQQ's price is reset every day to minimize the impact of the inherent return degradation from such an operation.

THE TQQQ 3x-LEVERAGED SCENARIO

February 3, 2025

In this strategy, we use the TQQQ ETF as a trading vehicle. And since TQQQ is a 3x-leveraged ETF, we should expect it to generate something approaching three times QQQ's long-term return. TQQQ behaves as a 3x-leveraged QQQ ETF, which tracks the NDX index composed of the top 100 highest-valued stocks on NASDAQ.

Few strategies operate at such levels. We have the Medallion Fund example, which has reached those levels over the past 30+ years (63% CAGR before fees, 39% net after fees). That fund is reserved for Renaissance's higher management echelons and is not open to the public. However, by doing it yourself, you could reach similar results and not be subject to such fees, making the total outcome your own.

FOR YOUR RETIREMENT, YOU NEED TO WIN. IT IS NOT A WISH

January 27, 2025

Over the last year, I wrote many articles about the One Percent Per Week stock trading strategy. It is an outstanding and highly volatile strategy that can nonetheless deliver over the long term, more than 50\% per year, on average. The reason for its success is its method of play, which seems, at least, to have worked for the past 15 years.

Using TQQQ is behind its higher volatility rating. If the general market could deliver some 15 to 20% compounded over the years, TQQQ, with its 3x-leveraged scenario based on the QQQ ETF, could produce about 3 times more.

I've shown in my article: If You Want To, You Can Make It Big, Real Big, that you could make it happen. It is an easy recipe to follow by hand or using the provided program code.

IF YOU WANT TO, YOU CAN MAKE IT BIG, REAL BIG

January 13, 2025

Over the last year, I wrote about the One Percent Per Week trading strategy. This outstanding strategy could be seen as highly volatile but could nonetheless deliver, on average, more than 50% per year over the long term. One reason for its success is that it has worked for over 15 years.

The trading procedures for this strategy are simple and could be done by hand in less than 5 minutes a week, even though the provided and free program code can do that job for you in milliseconds.

With If You Want To, You Can Make It Big, Real Big, I intend to show that you can reach the higher end of your retirement objectives using the presented trading method. We will go from the simple to the simple to the stupendous in no time at all. What follows might even be the most impactful document you read this year.

MAKE YOUR FIRST $50M BEFORE YOU RETIRE

January 6, 2025

This article is more of a recipe for making it than a hypothetical rendering. The intention is for you to build your retirement/investment fund to at least $50 million before you retire. And then, do the same a few more times after you retire by following the same recipe. All because you adopted a different kind of trading strategy.

The very first constraint will be time.

How much of it do you have before you retire? If you are already 60, this recipe will not get you there before age 65. But if you want to plan for when you will be 75 or 80, all this stuff could be of help. If you are 45 or younger, this should give you ideas on how to reach your goal and then some.

YOUR TRADING RULES MATTER

December 2, 2024

My free book, Gain Your Financial Freedom, made the case that applying some elementary trading procedures could generate outstanding, impressive, and long-term results. It even included the code to my modified version of a free Wealth-Lab 8 trading strategy designed to profit from short-term market volatility.

The program accepted the random-like nature of short-term price movements as if playing a heads or tails game and putting the outcome of each taken position as an unknown until the position was closed for some reason or other.

As in the above-referenced book, Your Trading Rules Matter, will demonstrate that a strategy's short-term trading rules matter. However, they will also have to work over extended periods.

Gain Your Financial Freedom

November 15, 2024

This new book is a fascinating and free trading strategy that can deliver results. It is all about your financial future and what you can do now that will get you there. That is, reach financial independence beyond what you thought possible, preferably before you retire.

High Stock Portfolio Returns? Easy

Sept. 30, 2024

High Stock Portfolio Returns? Easy will demonstrate that among your long-term investment choices, at least one strategy could propel you to unbelievable heights. And with little to do to get there.

The strategy is free and will be detailed at length. Your skills, your means, and the choices you are to make, if any, will determine the outcome. It is all doable. You decide how far you want to go.

In any stock portfolio, you enter trades and get out of them sometime later. It is almost the definition of a stock trade. You have an entry and an exit price. What you are interested in is the outcome. Will you make a profit or not on that trade? And that alone raises a lot of questions.

If we have equations that can fit the outcome of our trading strategies, does it not stand to reason that whatever or however those strategies trade, we should end up satisfying those equations?

Your Stock Trading Portfolio Destroyer

Sept. 19, 2024

We are constantly bombarded with the notion of investing in the stock market for the long term. The quest is often to build a significant investment or retirement fund. But, we also see the risk involved in "playing" the markets.

Early on, we learn that nothing is guaranteed and that there is much randomness in all those price moves. But you still have to make the best of it since you know that some long-term stockholders make a fortune. All the super-rich have significant stock holdings.

In Your Stock Trading Portfolio Destroyer, I will attempt to present the other side of the coin and also cover a part of why you need a positive edge in trading for the long term. Explore the negative side and show that total randomness in stock prices can destroy your stock trading portfolio, whether you like it or not. It will not be something you can escape either unless you opt to do something about it.

In my previous article, Stock Trading Strategy Alpha Generation, I used a geometric Brownian motion (GBM) as a long-term model for stock prices and portfolios. I will use it again for this demonstration.

You Will Earn Every Penny You Make

September 12, 2024

We do not always see the ease with which we could build a decent retirement fund. Often, it might just be the outcome of a single decision, which can turn out to be: will you do it or not?

The process will be boring since you will have to do the same things repeatedly, but we are accustomed to such things; it is called work.

You can decide to work for others or work for yourself. It is all a matter of choice. But, overall, you are the one to choose.

Over the past two years, I have written about using the QQQ ETF as a short-term and long-term trading vehicle. The goal was to build a retirement fund of significance, large enough to be financially worry-free for the rest of your life.

Stock Trading Strategy Alpha Generation

Sept. 03, 2024

In any stock trading strategy, we need an edge to win. We should be able to generate some alpha in excess of the expected long-term average market return. The alpha is not free. It is earned. It means you have to make it happen as a side effect of your trading methods.

We have to trade in an unpredictable future where stock prices will go up and down. Some stocks will even go bankrupt. Yet, you will have to generate that alpha in that uncertain environment. Otherwise, you will underperform or achieve, at most, the market average. Alpha generation is relatively simple to achieve, as Stock Trading Strategy Alpha Generation will demonstrate.

In my last article, There Is Always A Better Retirement Fund - Part II, I referred to the geometric Brownian motion (GBM), which has a drift component overlaid with a normal distribution of randomly distributed price variations.

There Is Always A Better Retirement Fund - Part II

August 22, 2024

In this article, I will elaborate on building your retirement fund using a stock trading strategy. One part is up to retirement, and the other for after you retire. I aim to show that you can do it yourself and easily outperform market averages.

My last article, There Is Always A Better Retirement Fund, covered the required growth rate needed to achieve a $50 million or a $100 million retirement fund based on the number of years before age 65 and available initial capital. It was also shown that a small added percentage to the CAGR, when applied early, could increase the outcome considerably, for instance, doubling the outcome.

It was all based on the future value formula: FV = PV ∙ (1 + r)t, which has existed for centuries. So, there was nothing new there. What was remarkable, however, was that a 25-year-old, starting with $100k, which could borrowed, could double his or her portfolio to $100 million dollars before retiring at 65 by adding 2.04% to the shown CAGR in Table #1, going from 16.81% to 18.85%. Only a 2.04% CAGR increase was enough to make the added $50 million dollars simply because it was given time.

There Is Always A Better Retirement Fund

August 12, 2024

Let's start with the basic fact that you need a worthwhile retirement fund. Furthermore, it better be large enough to sustain you in style with all the comforts of living for another 40+ years after you retire.

Life expectancy is expanding. More than half the children below five today will reach 100 years old.

A retirement fund can also be a legacy to your children so they can get a better life for themselves and their children.

If you "do" make it to retirement age (and your odds are highly likely you will), you definitely will "need" that retirement fund. By then, it will not be a wish that you should have done something about it; it will be a reality that nothing was done to secure your future financially.

Welcome To YOUR Stupendous Retirement Fund

July 29, 2024

Welcome To YOUR Stupendous Retirement Fund covers three aspects connected to the One Percent Per Week stock trading program: (1) the choice of the trading instrument, (2) a short walk forward on the strategy, and (3) ways of financing it all.

I want to improve on this program and find generalized and worthwhile methods to increase its long-term CAGR. The added code should increase its current high-performance level (>50%). I also want to reduce the impact of drawdowns, not eliminate them; I will not be able to do that, but I will reduce their drag on performance and overall impact on the system. That I can do, and you can too.

Parts I to VIII of my series of articles on the One Percent Per Week stock trading program were to understand this simple stock trading strategy better. The program (v5) has only three trading rules: all trades are limited to one week, the strategy takes a long position on Mondays if allowed, and will take a 7% or 8% profit target if it occurs before the week is over. That's it.

The One Percent a Week Stock Trading Program - Part VIII

July 15, 2024

Part VIII of the One Percent Per Week stock trading program will present more on the strategy's background, simulation results, and future potential. It is a prelude to directing program improvements and determining where and how they will apply within the program's structure.

In Parts I to VII of the One Percent Per Week stock trading program, I provided some background, simulations, math, and explanations for why this trading strategy can reach its high-performance levels.

Anyone could redo all the simulations performed using this free Wealth-Lab trading program. I am not the author, but I can use and modify that program and appreciate the ideas on which it is built.

I hope you come to appreciate this program and its potential as much as I do. There is no hype, no secret sauce, no scam, just the application of simple logic anyone can replicate. For one thing, it could help you build your retirement fund much faster than you thought possible. But as I see it, it is always your choice whether to do such things or not.

The One Percent A Week Stock Trading Program - Part VII

July 8, 2024

Part VII of The One Percent a Week stock trading program is intended to cover finding ways to protect the strategy from itself. In the process, this will change parts of its trading procedures. While at it, I will also push to increase its market exposure with new code aiming for 100% exposure, presently at about 51%. It might be one of the easiest ways to improve the strategy's long-term outcome since, nearly half the time, the available capital is idle. Putting it to good use should be sufficient to increase total return.

But first, I want to demonstrate that the results shown in previous articles were simply the outcome of the trading procedures used. There was no secret sauce, no hype, just common sense.

You merely participated, half the time, in the market for 14.31 years and were rewarded for it.

Parts I to VI of this series covered a lot of ground. I first improved the One Percent Per Week trading strategy, then leveraged it and even set up a 130/30 market-neutral portfolio. At each step, I raised the portfolio's long-term CAGR to unprecedented heights while at the same time maintaining critical portfolio metrics stable. The demonstration was to first show the strategy's upward CAGR potential before curling it in, at least attempting to reduce the downside effects of short-term trading. If I wanted to push the strategy further, I would know I could.

The One Percent A Week Stock Trading Program - Part VI

June 24, 2024

You want to win, and you want to win big.

You are on a mission to build an investment and retirement fund for yourself and your family.

The One Percent a Week Stock Trading Program - Part VI will unravel more of its hidden potential and show that the strategy is highly scalable. I will also cover leveraging the portfolio for higher profits and even go for market-neutral scenarios.

This series of articles should help you achieve your goals. The last article (Part V) ended with a CAGR of 56% over 14.31 years, and I would like this strategy to do even better. But first, you need to understand what the strategy does to gain the confidence and determination to make it work for you.

Part I to Part V of this series are the foundation for what follows. They provide the context to understand what the strategy can and cannot do. The primary purpose was to evaluate its return potential, validity, and viability based on historical market data and, more importantly, to set realistic expectations for the future.

The One Percent a Week Stock Trading Program - Part V

June 13, 2024

Part V of this series tries to answer why and how this One Percent Per Week strategy works and why it is expected to continue doing so. This program is technically playing a 3x-leveraged QQQ, thereby increasing its potential return and volatility by a factor of three. The strategy is leveraging the top 100 companies on NASDAQ, and they are not going bankrupt any time soon.

The One Percent Per Week program says it all. Its math expectancy and objective are simple. That 1% per week is a 67.7% CAGR: (1 + 0.01)52 = 1.6777. Over the long term, it would be almost impossible to achieve by following conventional 60/40 investment portfolios.

IF, based on whatever your short-term trading activities, you could get close to those results, you should be more than satisfied with your achievement. Currently, only a few might get close to that level. But things are changing. Skills and trading methods are improving all the time. Simple and brilliant methods are out there to help you achieve your goals.

The One Percent Per Week program is a simple trading strategy. You could execute it by hand in a few minutes a week. You could achieve a 50% CAGR for mostly sitting it out. One decision on Mondays, and possibly another on Fridays. In between, you let your limit order wait for its profit target exit. The trading script is simple enough that you could program it in most computer languages.

The One Percent A Week Stock Trading Program - Part IV

June 4, 2024

The One Percent a Week Stock Trading Program - Part IV will look closer at the strategy's stop-loss and profit target settings. We will analyze these preset constraints and their impact on a portfolio's outcome. For short-term traders, we will show that "Cutting your losses and letting your profits run" might not work as they thought it should.

Part I, II, and III unraveled a simple trading strategy anybody could use; it is free and available from Wealth-Lab. With a few minor modifications to the program, I changed the strategy's trading outlook and behavior in what should be considered a continuously turbulent stock market.

It responded with an impressive 56.66% compounded annual growth rate (CAGR), and this, over the last 14 years.

The One Percent a Week Stock Trading Program - Part III

May 22, 2024

In PART II, I covered STEP 1 of the modifications I would like to make to the free Wealth-Lab, One Percent Per Week stock trading script. In PART III, I will elaborate on the strategy's properties and demonstrate that applying a traditional stop-loss will negatively impact the final results. Also, stating better drawdown protective measures will be needed.

With only a few minor and well-placed program modifications, I changed the script's underlying trading philosophy and increased its CAGR to 56.66% over the last 14 years. This outcome far exceeds what we usually find in published trading strategies over the net. Yet, what was proposed was simply gaming a gambling strategy where the only reason to get in a trade was because it was a Monday.

The One Percent Per Week strategy is so simple that anyone with the means could do it. You don't even need a computer program. You could do it all by hand in a few minutes a week and be completely independent while building up your financial future. But I suspect you will still want to use the program.

The One Percent a Week Stock Trading Program - Part II

May 13, 2024

The One Percent a Week stock trading program's original mission was to buy at a 1% discount to each Monday's opening price. And sell at any time during the rest of the week with a 1% profit or liquidate the position at whatever price on Friday's close at the latest. Whether it be for a lower profit than 1% or a loss, which could occur often.

In the One Percent a Week Stock Trading Strategy - Part II, I will demonstrate a version of the program that can get close to it with no added effort. These modifications are also something you could do.

The 1% per week is ambitious; it's a yearly return of 67.7%, (1 + 0.01)52 = 1.677. It makes the strategy's theoretical objectives very appealing. Even getting close would be appreciated.

This free trading strategy will serve as our starting point and include the modifications outlined in the previous article (see Part I).

The One Percent a Week Stock Trading Program - Part I

May 2, 2024

This adventure starts with another trading program that is freely available on Wealth-Lab. This one is interesting, but what's more, it's simple. Its trading method, despite its simplicity, could work for years, even a lifetime, especially when building a retirement fund that will also be your legacy fund. Lasting a long time is mandatory and an essential requirement, even a prerequisite to undertaking such a journey.

The One Percent a Week program places a limit buy order at one percent below the opening price every Monday. Once in a trade, it will liquidate its position after reaching its profit target of one percent at any time during the week. If not, it will close the position near the close on the last trading day of the week (meaning Friday near the close).

The question is: Are the rules of engagement sufficient to generate worthwhile profits?

The Long-Term Stock Trading Problem - Part II

April 22, 2024

My previous article, The Long-Term Stock Trading Problem - Part I, presented a table analyzing a 25-year-old planning for a long-term stock trading portfolio to last a lifetime. He or she, intending to retire at age 65 and continue holding their stock portfolio while withdrawing a yearly income stream for their living expenses and more.

The calculations were from the reference point of a 25-year-old living up to 95. The timeline was preset, as was the initial capital of $100k. The choices offered were the growth rates at which his or her portfolio might grow.

As the article referenced shows, some of those rates were easy to get. For instance, simply holding QQQ over the period could give an estimated 15% CAGR, which would already be more than reasonable once retired and leave an enviable legacy to their children.

The Long-Term Stock Trading Problem

April 15, 2024

The objective is simple: build a long-term investment fund to provide a steady and meaningful income stream once you retire and leave a worthwhile legacy for your children.

You can do all that by building a long-term stock portfolio. Such an endeavor can take decades. However, you are not limited to only using stocks to do the job; you could use other long-term appreciating assets such as real estate, building businesses, amassing collectibles, or whatever you like, including doing your job.

This article will only discuss self-managed stock portfolios as a tool for creating a multipurpose and long-lasting investment and retirement fund.

The MoonPhaser Stock Trading Program

April 6, 2024

Way back in the day, on Wealth-Lab (circa 2004), there was a MoonPhaser trading script. The general idea was simple: you bought shares on the full moon and sold them on the new moon. The program has been free and operational since then, and contrary to popular belief, it did not break down over time. It still makes money and outperforms SPY, even after what should be considered a 20-year walk forward on market data it has never been aware of since its development stage 20 years ago.

Price market data was not considered in its design. The trade-triggering mechanics were unrelated to market prices, whether past or future market data. All it cared about was the phase of the moon. No one makes a 20-year walk forward due to changing market conditions and the total waste of time it would represent. But here, the trading procedure is outside market conditions and could last centuries should there still be a market to trade in by then.

Anticipating A Stock Portfolio's Long-Term Outcome

March 26, 2024

After over ten years, I am switching back to Wealth-Lab. It is an excellent program with all its new features. I will be able to do whatever I want, whether it be on single stocks, groups of stocks, or portfolios of strategies.

The primary objective of any stock trading strategy is to meaningfully outperform market averages and make you money, no matter which software you use. Otherwise, why go that route? You could buy a low-cost market index proxy and expect those long-term market averages.

Trend Or No Trend Revisited

February 2, 2024

In late 2011, I wrote an interesting article titled: Trend Or No Trend. It tried to answer the question: Do we need a trend to define the direction of our trade decision process? What if we did not use any?

The article compared eleven different trading strategies. Each has its procedures and trading rules. All the simulations used the same 43 stocks over the same time interval, from December 2005 to October 2011 (1,500 trading days or 5.83 years). The period includes the 2007-2008 financial crisis. None of the strategies escaped that market meltdown.

The 1,500 trading days were enough to gather information and worthwhile statistics. These simulations are more than ten years old. So, what do they have to teach us today?

An Old Trading Strategy Revisited: DEVX8

January 21, 2024

Over the last few weeks, I spent a lot of time fixing links in my articles that were causing 404 errors (file not found messages). These URLs had been changed for some reason or another. I have not determined the cause. Most of the job is now done: links to and within the 455 articles have been repaired. Some links within PDF and HTML files remain. These will take longer since I have to return to the programs that created them to correct the links. But I will get to it and do the job.

I write this note to apologize for any inconvenience it might have caused anyone.

While fixing the link problem, I reread articles from when I started this website in 2011. Over the years, I chronicled programs I was working on in my quest to find better long-term stock trading strategies. Trying to respond to the following: if a trading strategy cannot last or remain profitable, what is it good for since it could ultimately make you lose money? The answer was to design trading strategies with that in mind. They first had to last and be profitable.

The Big Open Project

December 13, 2023

I call it The Big Open Project because it is BIG. It is so big it could change the world's wealth distribution as we know it over the next half-century. And it is a wide-open invitation to anyone who can carry it out.

It will require entrepreneurs and their organizations to design stock trading software of significance. We have models like the Medallion Fund of Renaissance Tech, which has generated outstanding results for years and years.

The objective is to build some of the largest fund management organizations of modern times, all within 30 years or less.

It is an ambitious project, and it can be duplicated by many. I will provide the background, the methods, and the equations to guide you on your way. You be the entrepreneur you can be.

Reflexions On A Retirement Fund

December 4, 2023

In writing Reflexions On A Retirement Fund, my primary intent was to give anyone with the means the ability to build a meaningful retirement fund. That is, large enough to provide you with a prosperous and well-deserved retirement for as long as you may live while providing a more than worthwhile legacy for your loved ones. Or for any other purposes you might fancy.

I will show that it is relatively easy to build this retirement fund even though it is as hard as can be. Only a minority manages to do so, and I think anyone could be part of this should they have the conviction they can do it and give it enough time.

Your Investment And Retirement Plans

November 12, 2023

I want to cover two different investment plans. The first should be the most important to you, while the second is your backup plan – your retirement insurance policy.

You will have the advantage of knowing beforehand that executing your long-term retirement plan will succeed. It should give you more confidence to undertake your more risky investment plan. Knowing that whatever the outcome, whether it succeeds or not, you will win the game anyway. Due to your assured backup, your long-term retirement plan.

At the current pace, within 10 to 15 years, government pension plans might run out of money unless they can increase the return on their funds, increase contributions, raise the retirement age, or reduce benefits. They have not been able to remedy the situation over the last 20 years, so what would make you think they will be able to do so in the future? I have no confidence they will.

Catching Up On Your Retirement Fund

Oct. 2, 2023

Catching Up On Your Retirement Fund (Getting Near 45 Years Old. Time To Make Up For Lost Time).

My friend asked me, "How about people starting their retirement fund later in life, like at 45, rather than the 25 to 35-year-old scenarios you already presented?"

My recent writings were on how anyone could build their retirement fund on their own. It was shown there were considerable advantages in doing so. The most valuable was providing a significant and increasing income stream for the rest of one's life once they retired. The emphasis is on the word increasing.

This paper, Catching Up On Your Retirement Fund, provides the underlying equations to rebuild and validate any of the presented scenarios. You can fire up your favorite spreadsheet and redo everything yourself. So, there is no secret sauce, only common sense stuff. If you do this, it will result in that kind of thing. The big question is: will you dare do any of it for yourself and your children? You will figure out ultimately that money spells freedom.

How To Make It Anyway

Sept. 18, 2023

This new article, How To Make It Anyway, or How To Retire With A Lot More Than Enough, is about how you could design your long-term investment portfolio such that:

-

It will survive for a long time, a very long time

-

Outperform usual market benchmarks like the S&P 500

-

Continue to grow while in retirement

-

Increase your monthly retirement income every year

-

Require little of your time

-

Provide a substantial legacy for your loved ones.

A complete recipe for doing so is provided. It is all explained and supported by mathematical equations. The emphasis is on your long-term retirement needs. All the while having it under your control before and after retiring. The primary objective is to give you the financial freedom and peace of mind you aspire to.

Impact Of Fees On Your Retirement Fund

Sept. 5, 2023

In a previous paper, Retire A Multi-Millionaire, I made a case for an individual to self-manage his/her retirement fund. It was proposed in that paper that building your fund around the QQQ ETF could be sufficient to outperform market averages.

The case was well documented and presented several scenarios on how a person could enhance performance. There is a difference between mutual funds, ETF funds, and market averages. For instance, mutual funds have higher fees than exchange-traded funds.

I will use Table #3, as presented in the above-cited article, as a base for comparison. Here it is again:

Retire A Multi-Millionaire

August 29, 2023

RETIRE A MULTI-MILLIONAIRE - A Roadmap On How You Could Do It gives you the understanding, the blueprint, and the methods on how you could do it, that is, retire a multi-millionaire.

This paper has no hype, only ordinary stuff you can do yourself. Some of it requires a single decision. But that is up to you.

You will have two investment periods to consider. The first is up to retirement age, and the second starts after you retire. Simple equations govern both phases.

I propose you build your retirement fund using monthly contributions, except you will be the one to manage it to get better returns. An administrative decision could add millions to your retirement fund.

Sitting On Your Bunnies Might Be Your Best Investment Yet

August 14, 2023

This paper: Sitting On Your 'Bunnies' Might Be Your Best Investment Yet will show you have a choice in building a long-term stock portfolio designed to serve an increasing income stream of significance while in retirement and that your choice will be in the investment methods you will use. The emphasis is on an ever-increasing income stream while in retirement.

The expected overall performance level of your stock portfolio will depend on the average rate of return you can achieve or extract over the entire investment period. Essentially, you will have to choose your rate of return from your available choices.

The big question is: how much will YOU need?

Self-Managed Retirement Funds

July 6, 2023

This short paper, Self-Managed Retirement Funds, makes the case that one should look beyond their retirement date and see the legacy they can leave behind to their loved ones or any other purpose or rationale.

There are two phases in building a retirement fund. The first is to build that retirement fund up to retirement age. And the second is to have that fund provide you with a sufficient income stream that leaves you worry-free with the ability to do whatever you want. Make your retirement fund so large that, whatever your lifestyle, you are only nibbling at it.

Make Yourself A Glorious Retirement Fund

May 29, 2023

This paper: Make Yourself A Glorious Retirement Fund, has a simple proposition. You manage your retirement fund in two stages. One: up to retirement age 65 (your choice). And two: the after retiring, where you can withdraw from your fund the income stream you want while your fund can continue to grow, thereby continuously increasing your retirement income.

Make Yourself A Glorious Retirement Fund is more than hinting that you have some work to do. And that it is in your best interest to set up and control your own retirement fund, even during retirement. It is a continuation of the previous paper titled: The Age Of The Individual Investor, which set the foundations for this one.

The Age Of The Individual Investor

April 18, 2023

This new and free paper, - The Age Of The Individual Investor - addresses the future of everyone. It makes the point that a single and simple equation will totally change the world we live in. Not because it is the nature of things to change but because of this notion of profit.

Since everyone having the means to do so will try to manage their long-term funds or at least preserve some of what they have earned, they will be looking for ways to select growing assets. This search for profit will be a significant societal driver of change for the next 50 to 100 years.

First, there is the basic need to make a buck for a living. But, more importantly, there is also the need to profit from one's investments, the necessity of building a nest egg, no matter the nature of those investments.

Make Yourself A Bigger Retirement Fund

March 13, 2023

My new book, Build The Retirement Fund You Deserve. Be Rich, Be Happy could help you build your retirement fund while leaving you in control of it all up to retirement age 65 and after that for as long as you live. You would do it yourself, so there would be no intermediaries, management fees, or intervention from anyone. Moreover, while in retirement, you could withdraw funds at your own pace without being dictated to or bothered by some financial organization or government regulation. You would be in charge, in control. It would be your funds, and no one could force you to do anything.

The Necessity of Your Retirement Fund

March 5, 2023

My new book: Build The Retirement Fund You Deserve. Be Rich, Be Happy deals mainly with the impact of the future value formula may have on your retirement and how it will change the world as we know it. All the ingredients needed for this massive societal transformation have never been gathered in this fashion before.

The Future Value equation is FV = PV (1 + g)t. The formula is rather ordinary and has been around for centuries. It starts with the Present Value of some asset to which we apply a growth rate (g) over a number of years (t). This formula will significantly impact the world in the coming decades.

Build The Retirement Fund You Deserve

Feb. 28, 2023 NEW BOOK RELEASED

My new book: Build The Retirement Fund You Deserve. Be Rich, Be Happy is for either individuals wishing to build their retirement fund to enjoy the freedom and independence its proceeds can bring or for businesses and financial institutions having to build long-term funds for whatever purposes.

Build The Retirement Fund You Deserve will give you a recipe to grow your retirement fund over the long term while taking little of your time. So, get ready to be amazed by the wonderments of long-term compounding.

For individuals, this book could change your life and your children's lives. Large institutions could significantly increase their financial assets. But wait until you have read it all. It will change your mindset. Guide you in doing the stuff you need to do, not only for yourself but also for your loved ones.

Your Retirement Fund

Feb. 26, 2023

In my new book scheduled for an early March release: Build The Retirement Fund You Deserve. Be Rich, Be Happy. I cover a trading strategy based on the QQQ ETF and more.

Here is an equation from my book that should guide anyone in building their retirement fund:

![]()

We have a future value formula with five 20-year periods at varying growth rates and independent withdrawal rates for each period after the first 20 years. As long as the growth rate is superior to the withdrawal rate, the fund will continue to increase over time, even after 100 years.

Your Retirement, Your Time, Your Money

Dec. 2, 2022 Also available in PDF

You know you should build a retirement fund to last you a lifetime since you also know that without it, your retirement might not be as pleasant as it could be, moneywise, that is. The first hurdle, evidently, is money. If you do not reach retirement with enough, you will probably be missing out. The second hurdle, not surprisingly, is your age. If you start too late, you might not have enough time to make it worthwhile. And the third hurdle is you. Will you have the skills and perseverance to build that investment portfolio in the first place?

You are the one to decide what you want to do. Find ways to execute the needed tasks to get there. You will always be at the center of it all, no matter how you want to look at it. Every investment decision will matter, but mostly, only to you, since you will be the one winning or losing your own money. You remain the one, under market uncertainty or whatever happens to make all those decisions, even if by proxy. Having someone else do the job for you is your decision too.

A Walk-forward Example

Oct. 10, 2022

Here is a post I made (as is) about a walkforward on a QuantConnect thread. It should be to your benefit and, therefore, worthwhile.

The post presents one particular pitfall of automated trading, and that is no matter how promising a trading strategy might be, it could still go wrong and not perform as expected.

I would like to use a version of the "In & Out" strategy (frozen in time since October 2021) as a one-year walk-forward example.

The price data after October 2021 will be totally unknown to the strategy. It is assumed the strategy will continue to do what it was designed for and simply execute its code. After all, it was designed to do just that.

Long-Term Trading Strategy Planning

Oct. 3, 2022 Also available in PDF

Over the past year, I wrote a lot about a freely available trading strategy rebalancing QQQ's 100 stocks on a weekly basis.

It started with A Trading Strategy Of Interest (see the 13 related articles listed below). The strategy had nothing going for it in the sense that even if you used it as is, it would not outperform its Buy & Hold equivalent.

In fact, holding QQQ outright for the duration would have produced slightly better results than using that program. Not by much mind you, but still less than buying QQQ and holding. Regardless, the strategy could be improved performance-wise.

The strategy provided a testing ground where general trading principles could be examined. Simulations (44 in all) managed to show CAGRs of 20%+ over a 12.4-year period. You could technically choose the strategy's performance level based on the initial preset conditions provided. This should be viewed, at least, as noteworthy.

Stock Trading Skills

Sept. 26, 2022 Also available in PDF

In playing the stock market game, maybe the very first question should be: How much trading skills do you really need? To which I would venture, in many cases, practically none or very little. The game is simply too simple. Common sense might be your best asset ever.

What you might need, however, is sufficient capital, time, and some sustainable long-term method of play. You could even outsource the whole process should you not have the time to do it yourself. But that too, has its limitations.

For some reason or other, you buy stocks, one or many at a time, at the prevailing market price and then try to resell them or hold them, hopefully for a higher price. You repeat the process as many times as you want. But, it is more something like as often as you can, within your capital constraints, available time, and trading methods.

Your Stock Trading Game

Sept. 6, 2022 Also available in PDF

Your Stock Trading Game takes a look at trading stocks with a long-term perspective. It will use equations as a guiding light to higher portfolio returns. These equations will impose trading limitations as well as unleash a portfolio's long-term potential. If you do not plan your future or have no idea of where you are going, where do you think you will end up?

In my previous article, Basic Portfolio Math, we were shown 3 basic portfolio equations, all giving the same answer. From a world of short-term quasi-randomness, you could extract long-term expectations or at least some tools to estimate where it was all going based on your trading procedures and constraints.

You had choices to make from the start that would greatly impact the future outcome of your stock portfolio or retirement fund.

Basic Portfolio Math

Aug. 30, 2022 Also available in PDF

Basic Portfolio Math makes the case that certain stock portfolios can tell a lot about their future long-term outcomes based on their past simulated trading behavior.

It could help "predict" within a few percentage points their future value, even some 10 years hence and more.

This goes against many caveats we see about not knowing the future of an automated or discretionary trading system since its past is supposedly no guarantee of its future. True, but still, you could get pretty close to your forecasted expectations. Being able to make such an estimate or forecast is already a plus.

Recovering After A Bear Market

June 26, 2022 Also available in PDF

No matter how we trade stocks, our long-term objectives are pretty much the same as everyone else.

We want our portfolios to go up in value, not down.

We find the upside the most reasonable outcome for our investment strategies since it is why we made them in the first place.

Nevertheless, we have to plan for our portfolio's recovery after a significant decline, not by planning for what was or could have been, but for what will be coming our way.

We are averse to market drawdowns; no surprise there, we all are. Unfortunately, we have a really hard time avoiding them. The market can go down, but it is our job to recover from them and do even better. My recent articles (see related articles below) provided recovery equations to do just that.

Portfolio Drawdown Protection

June 7, 2022 Also available in PDF

Portfolio Drawdown Protection will cover how we can partially protect our stock portfolio from market drawdowns.

Will be shown that even a portfolio-level trailing stop-loss can limit the damage drawdowns can inflict on long-term performance.

Any drawdown should be considered a drag on any portfolio's overall return since we not only have to recuperate the downfall but also have to replace the lost opportunity that occurred during those market declines.

We need some more background on the process. First, we will consider how we can further raise the portfolio's long-term CAGR and then add protective measures. Doing the reverse, meaning adding protective measures first, will tend to curtail, from the start, our ability to increase performance beyond certain levels due to the very early limits we want to impose on our trading strategy.

Let the strategy rise as much as it can, and then set the limits you will find acceptable in your own trading scenario. If this makes your trading strategy produce a little less, so be it.

There is a price to pay for portfolio protection. We do not need to kill our future CAGR just because we want a little protection.

Compensate For Portfolio Drawdowns

June 1, 2022 Also available in PDF

My last article Surviving Market Drawdowns, which is also available as a PDF file, covered the need to exceed average market returns. It considered drawdowns and inflation which have long-term effects on stock portfolios. The article expressed the need to compensate, if not over-compensate, for these negative factors, which tend to dampen long-term returns and thereby act as a drag on performance.

I will extend that perception by examining the impact of 5 of the most significant drawdowns of the last 40 years.

Surviving Market Drawdowns

May 11, 2022 Also available in PDF

My last series of articles tried to cover a lot of ground. It was mentioned a number of times that the stock trading strategy used needed some protective measures since drawdowns could have quite a negative impact on long-term performance.

The following is mostly an extract from my upcoming book on building up your own retirement fund. It even covers generational funds made to last decades and decades.

Whatever type of stock portfolio you have or want, the objective is to generate long-term returns higher than just the market average.

The intention, no matter how you want to play the market, is to make as much as you can without giving it back.

QQQ To The Rescue

Jan. 5, 2022

There were still a few more things to share from the QuantConnect ETF Constituents Universe thread.

I have already written six articles on this freely available trading strategy, exploring its general behavior and showing the results of some 46 simulations where three variables controlled its outcome. Variables determined by administrative decisions before the program even started.

These variables were independent of the game being played but still determined how the strategy would play out. They were the initial capital used, which evidently would have a tremendous impact on the final result, the method of weighing stock positions, and the applied leverage.

The achievable growth rate was left to the strategy's trading mechanics.

Building Your Retirement Fund

Dec. 21, 2021

The purpose of the previous 5 articles was to show the relative ease of setting up your own indexed retirement fund, manage it and prosper even with little intervention of your own. Was given a recipe on how to do just that. A single common-sense decision could get it started, one you could make at any time of your choosing.

You simply copied an imitator of a market index and followed its weighted index. The QQQ ETF was used for that very purpose, an index tracker tracking the NASDAQ 100 index. It was demonstrated that you could trade QQQ's 100 highest-valued NASDAQ stocks or simply buy QQQ outright and hold it for the duration with a slightly better CAGR, as should be expected.

Build Your Own Indexed Retirement Fund

Dec. 2, 2021

My 4 previous articles dealt with a do-it-yourself profitable and freely available stock trading strategy using the QQQ ETF over a period of 12.24 years. From its simple procedures, other generalized notions can be extracted.

First, a recall. We had this free trading strategy essentially mimicking the NASDAQ 100 index. Thereby making it a basis for your own indexed fund. Results on 44 simulations were shown. All having two components. One: a simple stock selection procedure (totally outsourced by using QQQ constituent stocks), and two: a weekly scheduled and automated rebalancing routine (trading on whatever happened and whatever was there in QQQ at the time).

Thus, having our machine automatically trade once a week and effectively only for a few minutes since all trades were market orders. Anyone with access to money could do this, not something you would call time-consuming either.

Take the Money and Keep it – II

Nov. 15, 2021

There was more to extract from my previous article Use QQQ - Make the Money and Keep IT.

The presented free trading strategy in that article did two simple things. One, it completely outsourced its stock selection process, and two, it rebalanced weekly. That's it.

There are no trading signals, no technical indicators, no market timing routine, and no move to the sidelines in times of market turmoil. Not even a request for your opinion, feelings, state of mind, or market analysis. Quite a simple and productive "whatever happens" strategy of the suck it up type. This trading strategy is saying that you do not need anything special to win, in fact, you do not need anything at all (except access to money). It is interesting to see how this strategy could also apply to a lot of other strategies having similar trade mechanics. Much can be learned from this pure rebalancing play.

Use QQQ - Make the Money and Keep IT

Nov. 1, 2021

However you want to trade stocks, the objective is to extract money from the process and not give it back.

It might not matter much how it is done as long as it is done (honestly and safely, evidently).

The methods used will depend on your knowledge and understanding of the game you intend to play, your trading capital, and your trading skills. This free trading strategy (Creating your own index fund) is the same as used in Part I and Part II. As said, I found the strategy interesting for the simplicity of its stock selection process, its pure-rebalancing play, and its overall performance.

A Trading Strategy Of Interest - II

Oct. 20, 2021

As a follow-up to my last post, here are some additional observations. To put this in context, the last post presented a 12.16-year trading strategy simulation on a pure rebalancing play using the 100 stocks in QQQ, a weighted-by-market capitalization ETF. The strategy generated a 19.01% CAGR over the period, turning 100k into 830k or 1 Mil into 10.0 Mil with a 20.6% CAGR. Something better than most long-term market averages. The above-mentioned post also showed where to get a free copy of the program.

A Trading Strategy Of Interest

Oct. 9, 2021 Also available in PDF

Recently on QuantConnect.com, a trading strategy dealing with the QQQ ETF was published. You can find it HERE, where you can clone it and then test it for yourself if you want to.

The strategy caught my interest since all it did was rebalance QQQ on a weekly basis. It represented an opportunity to study the trade mechanics of a pure-play rebalancing in motion, something I wanted to revisit for some time.

QQQ is composed of the top 100 NASDAQ stocks by market cap. What could be the interest when you could just have bought QQQ and held on over the same time interval? Higher returns? Lower drawdowns? Something to do?

The Makings of a Stock Trading Strategy – PART II

Aug. 12, 2021

This HTML file can be very helpful to anyone designing automated short-term stock trading strategies. It has deep implications. It deals with correcting for long-term portfolio return degradation, how to fix it, and even how to reverse it.

It builds on mathematical equations used in describing the outcome of our trading portfolios and shows how easy it is to improve on these designs with simple trade-triggering techniques. As if saying that your trading procedures can be greatly improved just by requesting more and letting long-term compounding do its job.

The Makings of a Stock Trading Strategy - PART I

Aug. 2, 2021

There is math and gaming in building a long-term automated stock trading strategy. Some of it is quite elementary, and ignoring it could be unwise. The math sets limits, boundaries, and constraints on what you can or could do in trading stocks over the short to long term.

I use math to describe the game and see its limits, and when programming trading procedures, I try to enhance strengths and alleviate weaknesses within the confines of limited capital, limited time, limited know-how, and limited resources.

Your Automated Stock Trading Portfolio

July 18, 2021

The big word in the title is "automated". The process should start with your honed discretionary trading system using your trading rules, market know-how, and trade logic which you simply automated.

There is a lot of software out there to help you do that, not only simulate your strategy but also trade live. Why do it? Who would have guessed? Evidently, for the money. It is there, available any day of the week. Doing it right, getting close enough to your long-term goals should be more than enough and relatively easy to achieve.

On The Use of a Rebalancer, a Flipper, and a Flusher

June 6, 2021

This is another continuation of the last few articles found on my website dealing with the freely available In & Out stock trading strategy. This one is about gaining a better understanding of its trade mechanics. Without it, how could you determine what is really going on, and maybe more importantly, how could you "control" what it does? Or even better, what it will do going forward?

Forward, that is the keyword; that is where the money is. There is no real money to be made on a simulation over past market data. A simulation can only serve as a kind of feasibility study sampled out of the gazillions of other choices that could be made. Why is this trading strategy profitable? How could you make it even more so going forward? Those are questions in need of answers.

Making Money with no Fault of Your Own

May 1, 2021

Of the published automated stock trading strategies, you are presented with a diamond in the rough once in a while. You either ignore it or recognize it as such and try to find out if, indeed, it will have some real value after being cut and polished. It is a choice you have to make. You will still have to work to extract that gem and then enhance its value. To your credit, this is a very simple strategy.

The In & Out Trading Strategy - Analysis

April 1, 2021

This is a follow-up to my last article Basic Stock Portfolio Math. Trying to provide a different look at the inner workings of the In & Out stock trading strategy, which is freely available on QuantConnect, where you can modify it at will. The intent is to show how this strategy is making its money. It should prove interesting. The strategy is composed of only a few parts: a stock selection process, a trend definition section, and a trade execution method. Nothing very complicated.

Basic Stock Portfolio Math

March 9, 2021

The following HTML file deals with some of the basic math of a long-term stock trading portfolio. It reduces the problem to two numbers, one of which is a simple counter. Because trading over the years can imply a lot of trades, we have to look at the problem in terms of averages. What will the average net profit per trade tend to be when you have a large number of trades? It is a basic question that appears difficult to solve, and yet it can be greatly simplified. Whether you trade automated or by hand, the equations presented will still hold. The final outcome of a trading strategy is the result of simple math, simple equations, nothing complicated.

Designing Successful Stock Trading Strategies

Feb. 19, 2021

Designing a successful stock trading strategy has about the same objectives as developing your own money printing machine. That you trade on a discretionary basis or use some elaborate trading program to execute your trades does not guarantee you to win at this game, but you can easily put the odds in your favor of doing so.

In reality, the problem is very simple: you buy some stock (whatever the reason) and resell it later at a profit. You do it often. That is it. That is all the game. You do not need much to understand the mechanics until you do more than a few hundred trades. Then, you get to realize that the “game” is a little bit more “complicated”.

On The Notion Of False Discoveries?

Feb. 6, 2021

You design an automated stock trading strategy and will use historical data for your simulations. Right off the bat, all the stock prices you will use are part of recorded history, and therefore, what kind of “discovery” are you going to make should be the question?

All the data is already there in plain sight. All you have to do is access it. Somehow, for some, it is as if the price of AAPL over the last 20 years has eluded them. As if they had never seen it before or did not know what it did or what it stood for? AAPL and its related data are there, and that is up to yesterday. Period. We can immediately see the hindsight problem this can create.

Winning The Automated Stock Trading Game

Jan. 24, 2021

Here is another post made on a QuantConnect forum. It could be viewed as a follow-up to the articles Stock Portfolio Backtesting and The In & Out Stock Trading Strategy.

Is there something in @Vladimir's In & Out strategy (version 1.5)? What I see is that there is money in there. But you have to determine that for yourself. What follows is not intended to convince you. You have to do your own homework.

Is there an edge that could persist going forward? Is it of any consequence what this strategy did over its simulated past? Is this strategy overfitted or not? In all simplicity: is it worth it? There is so much that could be said about this strategy.

Stock Portfolio Backtesting

Jan. 12, 2021

The following post is in reference to a question asked on overfitting in a QuantConnect forum.

Any stock trading strategy designer should have views on this subject since somehow it gets in the way if not at the heart of any such strategy that it be live or simulated. I find overfitting indirectly related to the law of diminishing returns. Meaning that going forward, your trading strategy will produce less over time. However, it can also be viewed in light of another problem, and that is to think that the market will strictly follow our often misconceived and poorly designed trading strategies. It should be forcefully noted that the market has no such obligation.

The In and Out Stock Trading Strategy

Nov. 16, 2020

Following Quantopian's shutdown, some of Quantopian's members moved the In & Out strategy to QuantConnect. I moved there too, and started reading the documentation. Also started analyzing this adapted strategy and doing some simulations of my own. The following is my first post on QuantConnect relating to this freely cloneable strategy.

Going For Better Portfolio Returns

Nov. 1, 2020

I was about to answer a question in a Quantopian forum when they opted to shut down their community website. Here is that post anyway. It is trying to answer the question: could someone use stocks based on the highest relative strength above a market average proxy? The strategy's code was given in the thread titled: New Strategy — “In & Out”, where anyone could make a copy of it and then modify it at will.

Playing a Long-Term Game - Part III

Oct 17, 2020

The previous post showed the outcome for long-term portfolios where returns were randomly generated. Even under randomness, it resulted in return degradation making the game not worth playing. Adding some alpha would make a portfolio profitable. And, if you added more alpha, the long-term CAGR could increase even more.

All simulations were unique. A new random return series would be generated for each and every one of the tests (over 300). We could anticipate that most tests would come out close to some average, whatever that average might be. This was illustrated in the charts, figures, and equations in the previous post.

Playing a Long-Term Game - Part II

Oct. 10, 2020