July 6, 2019

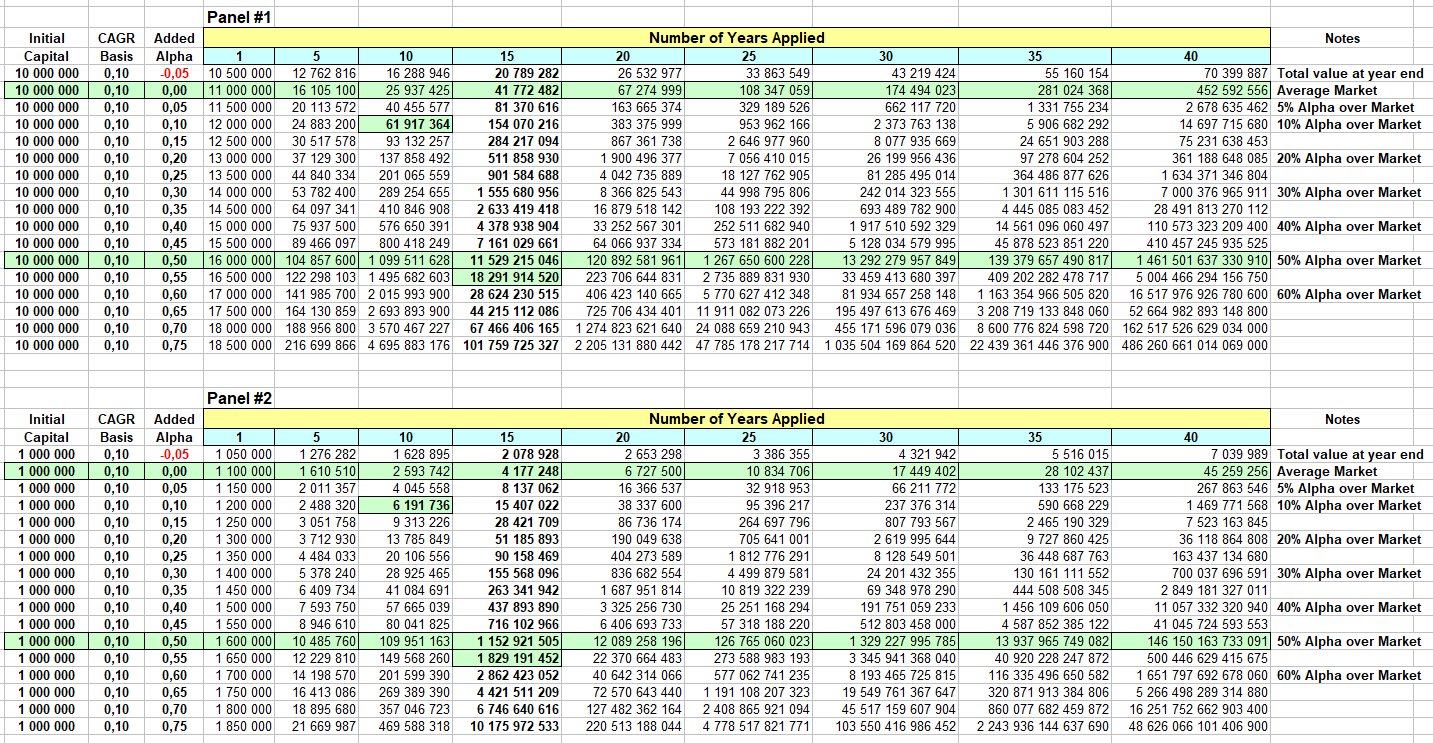

The chart below shows the value of having some alpha over the long term. It can easily be reconstructed using the formula: Init. Cap. ∙ (1+ E[rm] + α)t, where rm is the long-term expected historical market return, and alpha is the added performance over and above this average market return.

The calculations are based on the initial capital and are performed over (t) years. You could remake such a table to show every year for each alpha point.

(click to enlarge)

The table shows the added performance when adding alpha and time to a strategy's total return. With it, you can estimate the value of the added alpha based on its outcome and evaluate the difference between two periods, two alphas, or both.

For instance, in panel #1, the 50 alpha points over 15 years give $11,529,214,046, while the 10 alpha points over 10 years give $61,917,364. The difference is the pursuit of the added alpha over a longer time period. It is clear what one should look for. Evidently, if you want the higher figures, you will have to design your trading strategy to get there. And that is not always an easy task.

Mr. Buffett, for example, has maintained 10 points of added alpha over his 50+ year career, which would have generated over $91,004,381,500 starting with his $10M initial capital. A remarkable achievement.

The chart also says that adding 5 additional alpha points over the 50 alpha points over 15 years is worth $6,762,699,474. The difference between the two cells you choose gives you the value of the time factor and the alpha points.

This way, you can compare adding or subtracting time and/or alpha points. If you could add 5 more years to the above comparison, the difference would be $102,892,062,870. That is the value of time and the power of compounding. It could also be viewed as the opportunity cost for not doing the added 5 years.

If you have access to less money, then panel #2 will show the built-in opportunity cost of not having it. Every dollar amount is 10 times less than in panel #1. And, as you increase the alpha over time, the difference between the two panels becomes extremely large. But, there too, you have a choice. You are the designer of your own trading strategies. I would suggest getting that added capital and making those strategies count.

The game is all about money, not about sentiments, fears, or greed. It is about money, all the time, and depends on every trade you can or will take. There is math to this game, so why not learn how to use it?

Should you not like your max drawdown numbers, then program protective measures in order to alleviate the problem. It will cost (lower returns), but if that is what you want or prefer, just do it. The main reason for protective measures should be to avoid blowing up your account since then you would be out of the game. There is a price for everything you do in the market, and risk is always part of it.

Created. July 6, 2019, © Guy R. Fleury. All rights reserved.