Ranked Selection Backtest 7¶

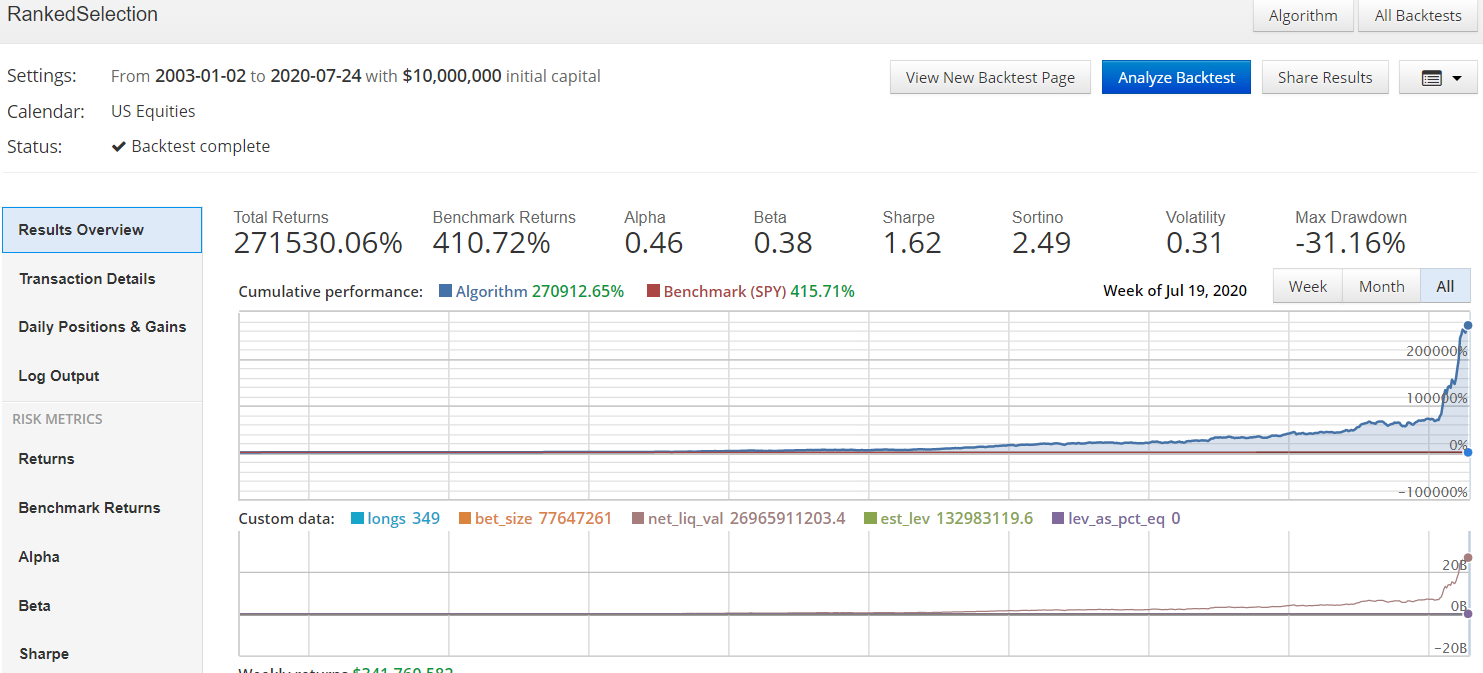

This is a follow up to notebooks 4, 5, and 6. Average gross leverage is raised from 1.61x to 1.67x, a 4% increase. Again, this is not a major move. However, it does increase leveraging costs, but it also raises the overall return. The added profits are more than sufficient to cover the added trading expenses. The estimated leveraging costs are displayed in the equity line chart below.

Tearsheet Options

bt.create_full_tear_sheet(round_trips=True, hide_positions=True, live_start_date='2019-11-29')

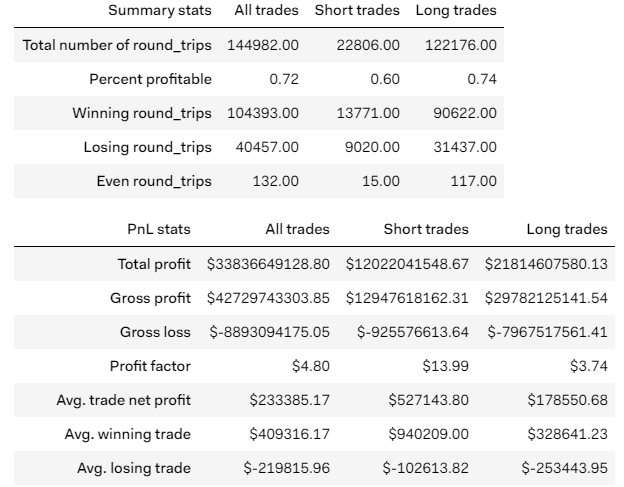

The following charts are the same as used in the previous simulation. In the backtest analysis, my favorite section is: round_trips = True. It is where I get the numbers for my equations.

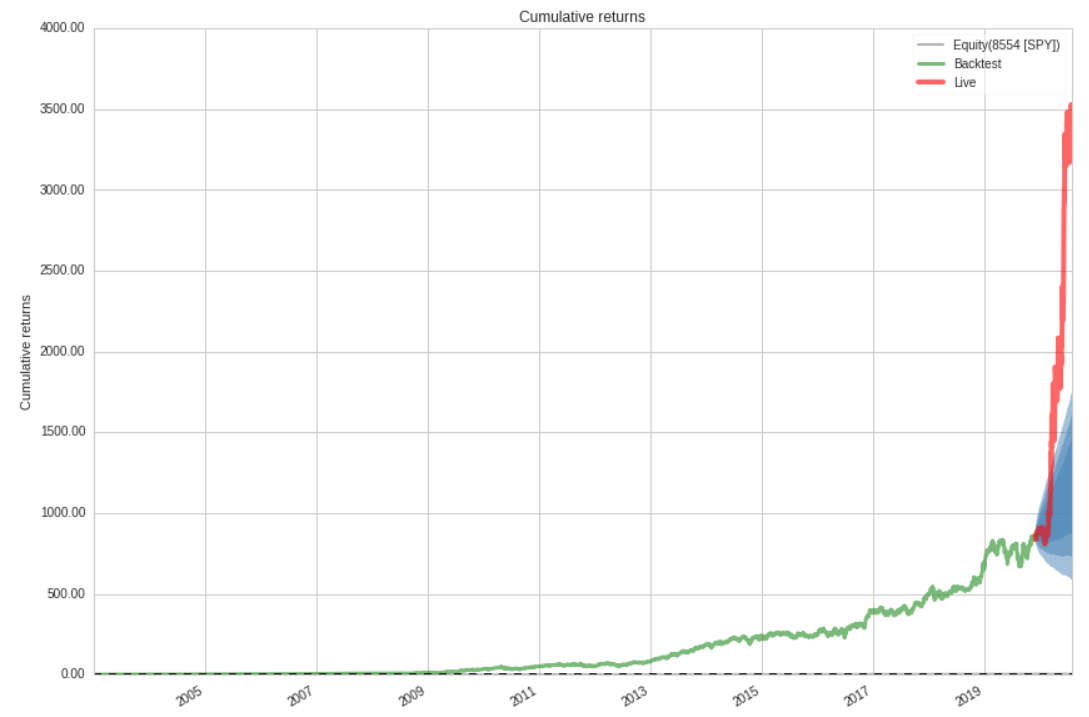

Cumulative Returns:

My Preferred Section: (with round_trips = True)

Equity Line:

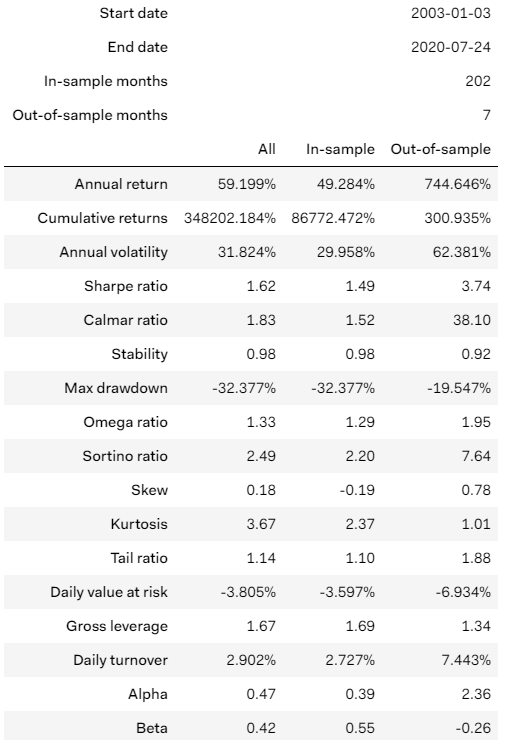

Portfolio Metrics: